michigan use tax exemption form

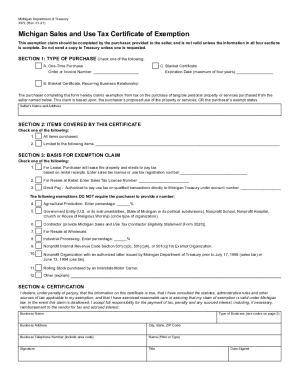

Michigan Department of Treasury Form 3372 Rev. TYPE OF PURCHASE DA.

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

All claims are subject to audit.

. Michigan Sales and Use Tax Contractor Eligibility Statement. This claim is based upon. Buildings Safety Engineering and Environmental Department.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. All claims are subject to audit. 2020 Aviation Fuel Informational Report - - Sales and Use Tax.

For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan. Many tax forms can now be completed on-line for printing and mailing. Certiicate must be retained in the Sellers Records.

Seller s Name and Address. The purchaser completing this form hereby claims exemption from tax on the purchase of tangible personal property or services purchased from the. 03-16 Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS.

This certificate is invalid unless all four sections are completed by the purchaser. Fill out the Michigan 3372 tax exemption certificate form. The purchasers proposed use of the property or services.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigan Department of Treasury Form 3372 Rev. Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number.

Certificate must be retained in the Sellers Records. TYPE OF PURCHASE One-time purchase. Tax Exemption Certificate for Donated Motor Vehicle.

Tax Exemption Certificate for Donated Motor Vehicle. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Certificate must be retained In the sellers records.

Either the letter issued by the Department of Treasury prior to June 1994or. OR the purchaser s exempt status. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Tax Exemption Certificate for Donated Motor Vehicle. Obtain a Michigan Sales Tax License. Your federal determination as a 501 c 3 or 501 c 4 organization.

All claims are subject to audit. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. This certiicate is invalid unless all four sections are completed by the purchaser.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Michigans use tax rate is six percent. Michigan Department of Traasury 3372 Rav.

Michigan Department of Treasury 3372 Rev. 2022 Aviation Fuel Informational Report - - Sales and Use Tax. The following exemptions DO NOT require the purchaser to provide a number.

11-09 Michigan Sales and Use Tax Certificate of Exemption DO NOT send to the Department of Treasury. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualifi ed transactions. This certificate is invalid unless all four sections are completed by the purchaser.

Michigan Sales and Use Tax Contractor Eligibility Statement. Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Purchaser Refund Request for a Sales or Use Tax Exemption.

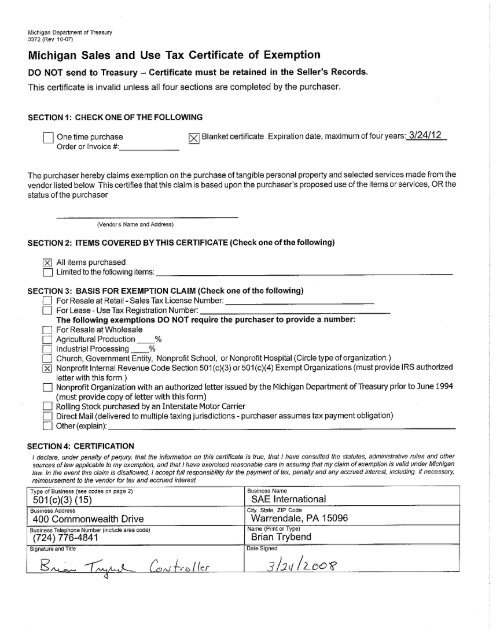

7-05 Michigan Sales and Use Tax Certificate of Exemption TO BE RETAINED IN THE SELLERS RECORDS - DO NOT SEND TO TREASURY. 2021 Aviation Fuel Informational Report - - Sales and Use Tax. Church Government Entity Nonprofit School or Nonprofit Hospital Circle type of organization.

If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the seller at the time of your purchase. In order to claim exemption the nonprofit organization must provide the seller with both. Civil Rights Inclusion Opportunity Department.

Present a copy of this certificate to suppliers when you wish to purchase items for resale. This certlflcate Is Invalid unless all four sections are completed by the purchaser. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

Department of Public Works. Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your. Michigan Sales and Use Tax Contractor Eligibility Statement.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. TYPE OF PURCHASE One-time purchase. DO NOT sand to tha Department of Treasury.

For other Michigan sales tax exemption certificates go here. Ad Fill Sign Email MI DoT 3372 More Fillable Forms Register and Subscribe Now. See Notice of New Sales and Use Tax Requirements.

Many tax forms can now be completed on-line for printing and mailing. 08-12 Michigan Sales and Use Tax Certifi cate of Exemption. 8-09 Michigan Sales and Use Tax Certiicate of Exemption DO NOT send to the Department of Treasury.

Many tax forms can now be completed on-line for printing and mailing. All claims are subject to audit. SOM - State of Michigan.

Purchaser Refund Request for a Sales or Use Tax Exemption. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. Purchaser Refund Request for a Sales or Use Tax Exemption.

Get And Sign Form 3372 Michigan Sales And Use Tax Certificate Of 2021 2022

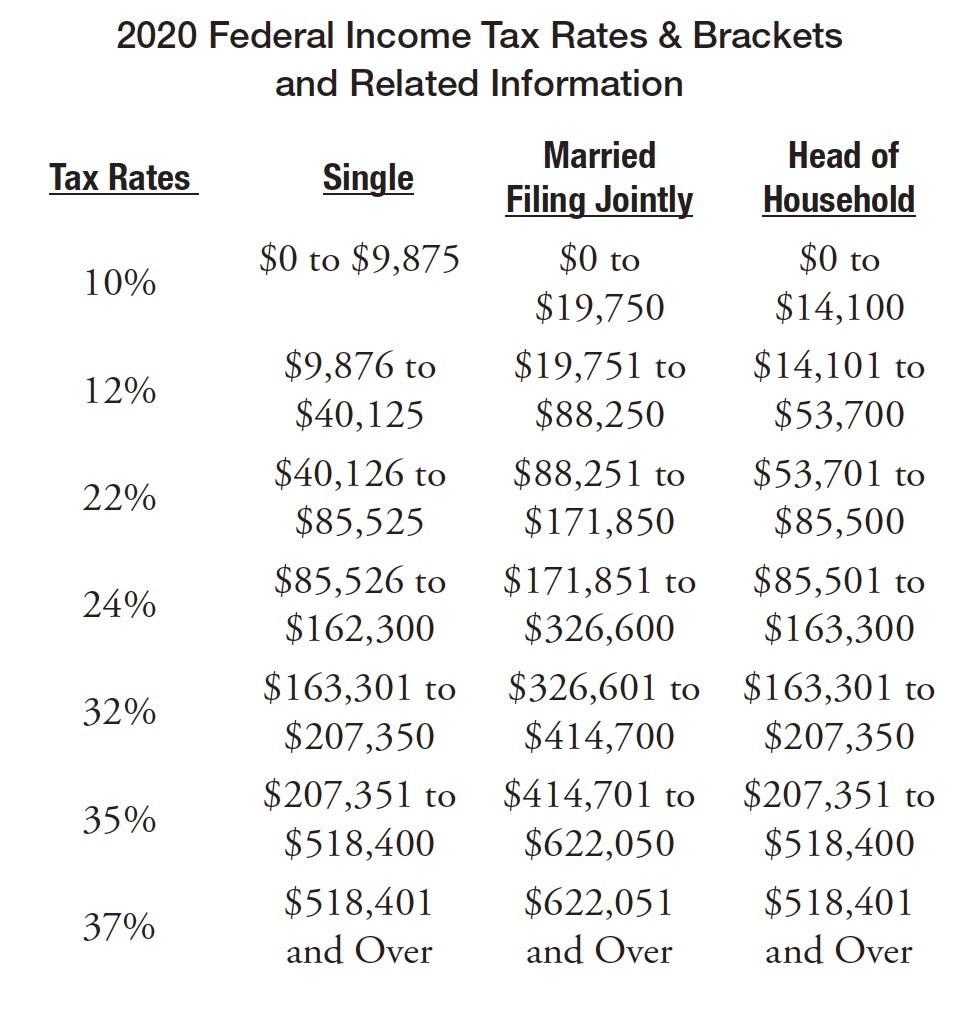

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Sales Tax License Michigan Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

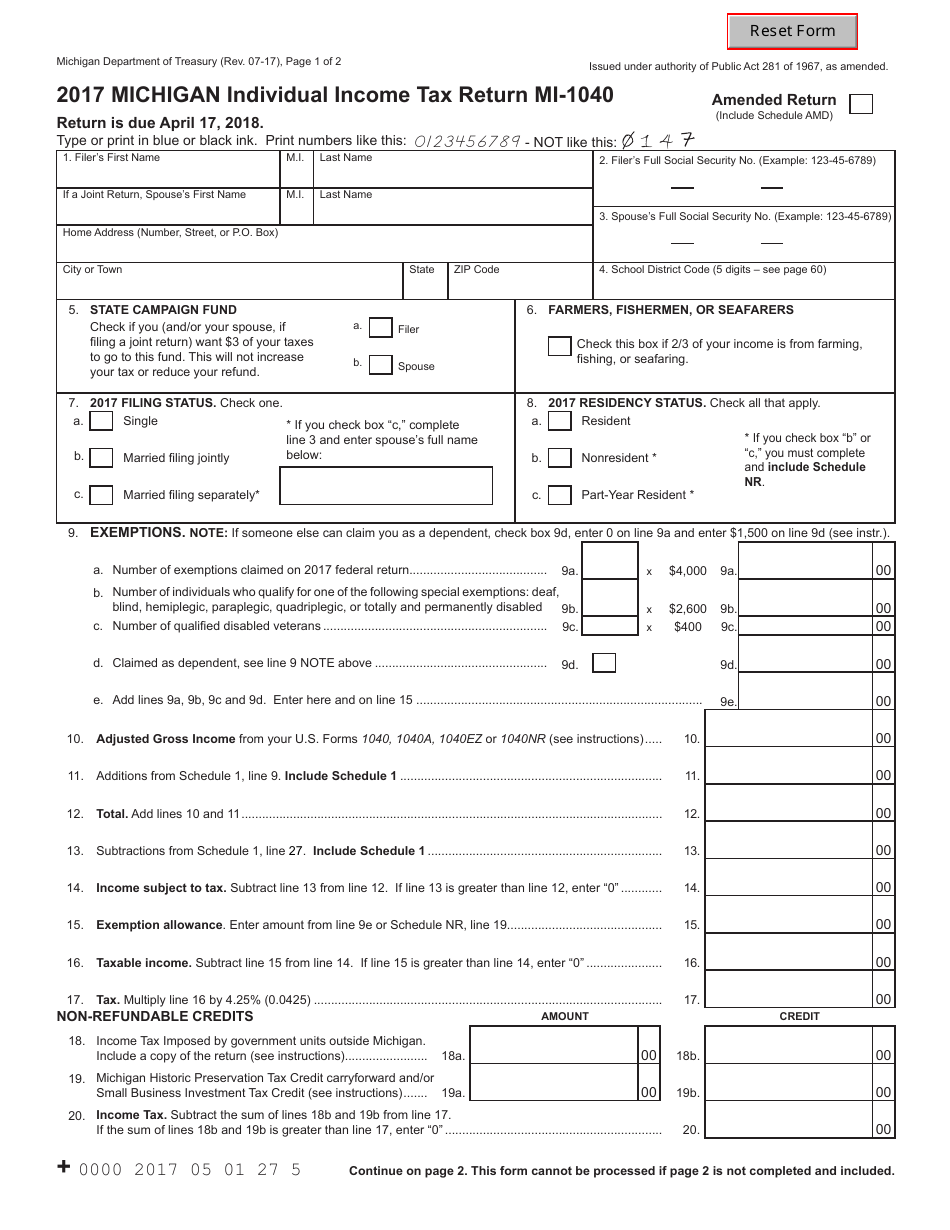

Form Mi 1040 Download Fillable Pdf Or Fill Online Michigan Individual Income Tax Return 2017 Michigan Templateroller

Michigan Sales Use And Withholding Taxes Annual Return Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller